Financers pressure shipping industry to clean up its recycling practices

Banks, pension funds and other financial institutions are increasingly asked to take into account social, environmental and governance criteria when selecting asset values or clients. Investing with an eye to environmental or social issues, not just financial returns, is in demand, and the credit providers and investors of shipping are now actively taking a closer look at how they might contribute to a shift towards better ship recycling practices off the beach.

Through what is known as “negative screening”, investors are using the annual lists that the Platform publishes on global dumpers to screen their portfolio. In 2018, Scandinavian pension funds the Norwegian Government Pension Fund Global and KLP divested from four shipping companies due to their beaching practices. The exclusions were made public and with written explanations. Both the breach of international human rights and the severe environmental damage caused by beaching were highlighted as reasons for the divestments.

Banks play a crucial role in supporting economic activity through their lending. They can also influence better business practices through engaging with their clients on social, environmental and governance matters. Starting off as a Dutch bank initiative with NIBC, ING and ABN AMRO as founding members, large Scandinavian and German shipping banks are now also part of a group of banks that promote responsible ship recycling and negotiate clauses to that aim in the loan agreements they sign with shipping companies.

The financers of shipping have signaled that there are likely further exclusions to come. In light of the announced decommissioning in the oil and gas sector, it is further likely that investments in oil and gas assets will be also scrutinized.

RECOMMENDED READINGS

Latest News

Press Release – Ship scrap steel can help decarbonise European steelmaking, highlights a new report

NGO Shipbreaking Platform, in collaboration with Sandbag – Smarter Climate Policy and the University of Tuscia, publishes a thorough report on the role of scrap steel from… Read More

Platform News – EU Circular Economy Act: ship recycling can help decarbonise the EU’s steel and construction sectors

With a significant number of ships expected to reach the end of their service life in the coming years, ship recycling presents a strategic opportunity for Europe… Read More

Related news

Platform News – EU Circular Economy Act: ship recycling can help decarbonise the EU’s steel and construction sectors

With a significant number of ships expected to reach the end of their service life in the coming years, ship recycling presents a strategic opportunity for Europe… Read More

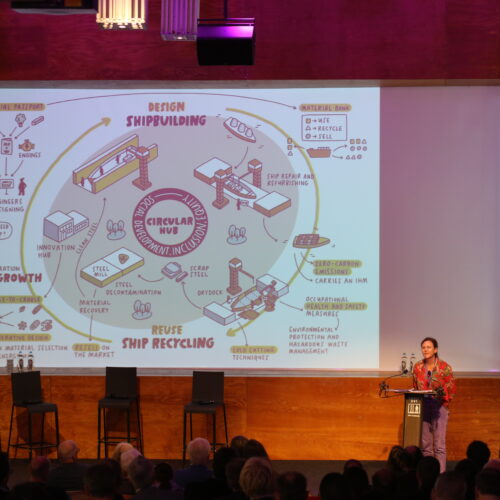

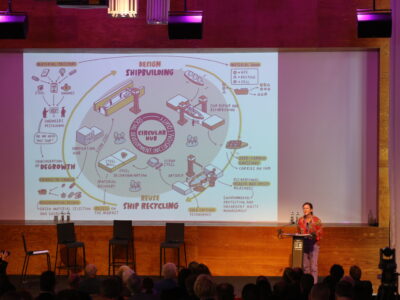

Press Release – Ship Recycling Lab’s 2nd Edition: when ethical leadership and cutting edge technology meet, sustainable ship recycling is on the horizon!

Over 100 participants met in Lisbon on 9-10 October.

... Read More

Platform News – SAVE THE DATE: Ship Recycling Lab on 20-21 September in Rotterdam

The NGO Shipbreaking Platform invites you to attend the conference Ship Recycling Lab on 20-21 September in Rotterdam (Netherlands).

... Read More

Press Release – Platform publishes list of ships dismantled worldwide in 2018

744 large ocean-going commercial vessels were sold to the scrap yards in 2018. Of these vessels, 518 were broken down on tidal mudflats in South Asia.

... Read More

Press Release – Platform supports banks’ introduction of responsible ship recycling standards

Today, during the first day of NOR-Shipping in Oslo, Dutch banks ABN AMRO, ING Bank and NIBC, together with the Scandinavian DNB, announced that they are… Read More

Platform News – Norway’s largest Pension Fund highlights human rights and environmental risks related to shipbreaking in South Asia

KLP, Norway’s largest pension fund [1], commissioned the International Law and Policy Institute (ILPI) [2] to write a report on the human rights and environmental risks related… Read More